A bipartisan bill titled the “American-Hellenic-Israeli Eastern Mediterranean Counterterrorism and Maritime Security Partnership Act of 2025”…

Sales of the largest arms manufacturers saw a marked increase last year due to the wars in Ukraine and the Gaza Strip and tensions in Asia, with the most notable turnovers being achieved by manufacturers in Russia and the Middle East.

Sales of arms and military services by the world’s 100 largest industries totalled $632 billion in 2023, up 4.2%, according to the Stockholm-based International Peace Research Institute (SIPRI).

They had declined in 2022 due to global giants’ inability to meet rising demand, but many companies have since been able to ramp up production in 2023, the report noted.

An indication of the large increase in demand: the 100 companies included in the list, all without exception, recorded a turnover higher than one billion dollars last year. The sales of the hundred greatest worldwide do not yet fully reflect the scope of demand, and many companies have started recruitment campaigns.

Smaller industries have proven more agile to new demand, attributed to the wars in the Gaza Strip and Ukraine, rising tensions in East Asia, and rearmament programmes of countries in other regions, SIPRI said.

The world’s largest arms industries, the US, saw their sales increase by (+2.5%) in 2023 and continue to account for roughly half of the sales revenue at the international level, with 41 US companies among the 100 largest in the world.

Also read: SIPRI | Nuclear arsenals are growing again

Lockheed Martin (–1.6%) and RTX (–1.3%), the two largest arms manufacturers in the world, recorded declines in turnover, as they often depend on complex and multilayered supply chains, which makes them vulnerable to persistent supply chain challenges in 2023.

Europe, with 27 groups, recorded only a 0.2% increase in sales last year, but this conceals a dual reality.

European industries, which produce complex equipment systems, were still fulfilling contracts from the previous year, which do not yet reflect the substantial orders they have since received.

Other groups, on the other hand, saw their turnover increase greatly due to demand linked to the war in Ukraine, particularly for artillery ammunition, air defence systems, and ground systems, according to SIPRI.

The figures concerning Russia, although incomplete, appear to reflect the situation in a country operating under a war economy. The sales of the two Russian groups included in the ranking recorded a huge increase in turnover (+40%), mainly due to the increase in sales of the public enterprise Rostec, according to SIPRI.

Arms industries in the Middle East (+18%) saw sales increase due to the war in Ukraine and the early months of Israel’s military operations against Hamas in the Gaza Strip after October 7, 2023.

Three Israeli manufacturers included in the ranking thus recorded a record turnover of $13.6 billion.(+15%) while three Turkey-based industries, notably drone maker Baykar, saw sales surge (+24%) due to the war in Ukraine and Ankara’s willingness to spend more on military equipment.

The general trend towards rearmament in Asia is particularly evident in the increased sales of four South Korean manufacturers (+39%) and five Japanese (+35%), while in contrast in China nine major industries are doing rather markedly (+0.7%), as the economy is at low growth rates.

READ MORE

Germany | 5,000-Man Armoured Brigade in Lithuania to Bolster NATO’s Eastern Flank

Germany officially commenced its first permanent deployment of foreign troops since World War II on Tuesday.

EIB | Measures to Finance European Security and Defence and Critical Raw Materials

The European Investment Bank (EIB) has agreed on a series of measures to further boost investment in security and defence, as well as in critical raw materials.

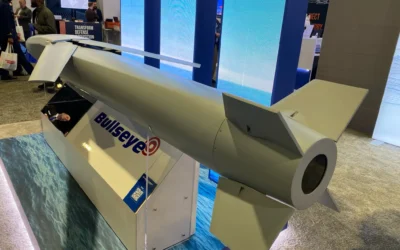

General Atomics – Rafael | Collaboration on the Development of the New Bullseye Cruise Missile

The US company General Atomics and the Israeli company Rafael have announced the commencement of their cooperation on the development of a new long-range…

FLANQ | AI-Powered Autonomous Maritime Solutions in Favour of European Security

In response to Europe’s growing security challenges in the maritime domain, FLANQ has launched as a new…

CERIDES | 1st Planning Conference of the UCPM DEMONAX – Cyprus Earthquake Full-Scale Exercise

CERIDES – Centre of Excellence in Risk and Decision Sciences of European University Cyprus had a strong presence during the 1st Planning…

EMAK | New Operational Boost with Eight INTRUDER SE Drones

The Ministry of Climate Crisis and Civil Protection is moving forward with the procurement of eight INTRUDER SE-type unmanned aerial…

KNDS France – METLEN | Partnership for the Production of the VBCI PHILOCTETES® in Greece

METLEN has entered into an exclusive partnership with KNDS France for the production of the latest-generation French 8×8 Infantry Fighting…

USΑ | Bipartisan Bill Submitted to US Congress to Lift Cyprus Arms Embargo

A bipartisan bill titled the “American-Hellenic-Israeli Eastern Mediterranean Counterterrorism and Maritime Security Partnership Act of 2025”…